For many people, a chronic condition such as heart disease or cancer starts a downward spiral of declining health and rising bills. A life insurance policy can help you improve end-of-life quality—here’s how.

In a viatical settlement, a terminally ill policyholder sells his/her life insurance policy to investors through a viatical broker. Once investors purchase the policy, the insured (now the “viator”) names them as beneficiaries and owners. The investors pay premiums and receive the death benefit when the viator dies. In return, the viator receives a lump sum payment ranging from 60 to 80 percent of the death benefit. This varies with the profit the investors think they can make. The longer a viator lives, the more premium payments they will have to make and the lower their profit. When entering into negotiations for a viatical settlement, the potential viator must be prepared to answer detailed questions about his/her medical condition.

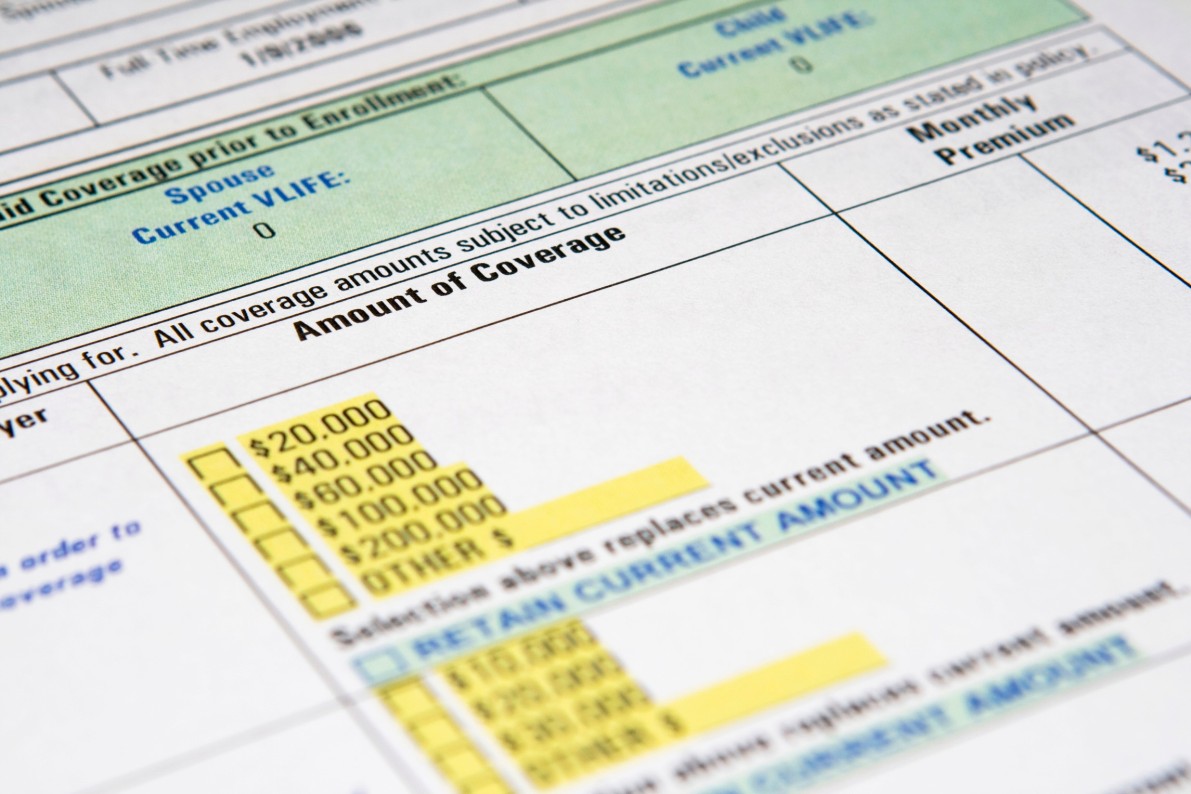

In a life settlement, those seeking to sell their life insurance policies are not necessarily ill; they are long-term policyholders who either cannot afford premium payments or think they don’t need coverage anymore. Many are seniors who want to access the cash value built up in their policies. In a life settlement, an insured can expect to receive more than the policy’s cash surrender value (or the amount the insurer would pay if the policy simply lapsed) and less than the death benefit (or face value). As with a viatical settlement, a specialized broker handles the transaction, and takes a commission from the amount an investor pays for your policy.

Many policies include accelerated death benefits (or “living benefits”) provisions that allow a policyholder to receive a significant portion of the death benefit before death. To qualify for accelerated death benefits, the insured must:

• Have a terminal illness, with death expected within 24 months.

• Have an acute illness that would result in a drastically reduced life span without extensive treatment.

• Have a catastrophic illness requiring extraordinary treatment, such as an organ transplant.

• Need long-term care due to being unable to perform a number of daily living activities, such as bathing, dressing or eating.

• Be permanently confined to a nursing home.

(Source: American Council of Life Insurers)

Many life insurance policies include accelerated death benefits or living benefits provisions at no additional charge. If your policy does not include this provision, you may be able to add it in a policy rider.

A policyholder can expect to receive from 25 to 95 percent of the policy’s death benefit as accelerated benefits. The payment you actually receive will vary according to policy terms, the policy’s face value and the laws of your state. Some states limit the percentage of the death benefit that you can accelerate. You might have to pay the insurer a small service charge.

One of the benefits of accelerated death benefits over viatical settlements or life settlements is that you will be dealing with an insurer you already know and trust, an organization subject to rigorous regulation and consumer protection laws in all 50 states.

Policy loans offer another option to the owner of a permanent life insurance policy. If your policy has built any cash value, you can borrow up to that amount from the insurer at the interest rate specified in the policy. If you die before repaying the loan, the insurer will subtract the loan amount, plus accumulated interest, from the benefit payable to your beneficiaries. A policy loan offers the further advantage of letting you keep your policy in force.

For more information, please contact us.